The 50-20-20-10 Budgeting Method Promises to Increase Your Earnings

Don’t misunderstand me; budgeting techniques can be useful in managing grocery expenses alongside indulgences like coffee shop visits. However, to be honest, many of them leave me feeling more exasperated than motivated. Moreover, our previously reliable budgeting strategies seem a bit outdated. In today's world, incomes are more unpredictable, and prices are rising across the board. Prioritizing anything beyond the essentials has become increasingly challenging. During such times, investing in oneself and one’s future feels more like a distant fantasy than a reality. Fortunately, there exists a budgeting method that focuses on more than just immediate needs, with its creator claiming it could enrich your future self. I’d like to introduce the 50-20-20-10 method. Below, we outline what it entails, how it differentiates from other budgeting models, and how to leverage it for greater wealth.

**MEET THE EXPERT**

Maggie Sellers

Maggie Sellers is a media entrepreneur, investor, and the outspoken voice behind Hot Smart Rich. With a background in high-growth startups and consumer venture capital, she has established a platform that empowers ambitious women to embrace their aspirations, beauty, and earning potential. Through her podcast, investments, and viral content, she demystifies how to build iconic brands and live boldly and intentionally.

**What is the 50-20-20-10 method?**

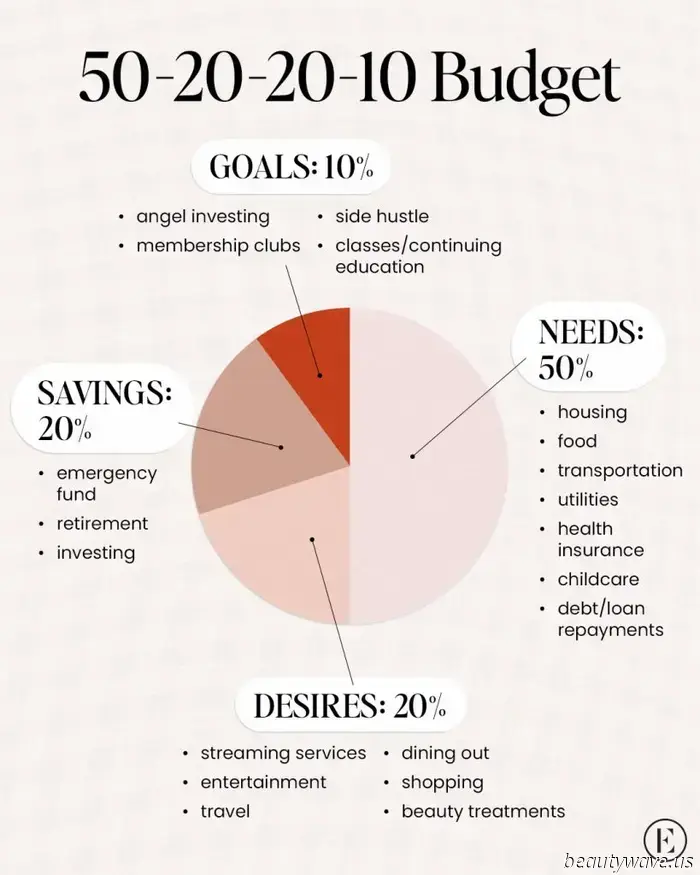

The 50-20-20-10 method is a contemporary revision of the 50/30/20 rule, which suggests designating 50 percent of your after-tax income to living costs, 30 percent to personal expenditures, and 20 percent to savings. This adaptation incorporates a few small but significant changes that keep your best interests in mind. With this approach, you allocate 50 percent of your after-tax earnings to necessities, 20 percent to wants, 20 percent to savings, and crucially, 10 percent to goals.

Maggie Sellers, the originator of this budgeting approach, argues that to become “hotter, smarter, and richer,” you must invest in your aspirations. These might include higher education or angel investing—motivations that inspired her to develop this method. Your goals in this category are those that can enhance your income over time. For instance, you might want to save for online courses that make you eligible for higher-paying jobs. According to Sellers, these budgeting categories enable women to enjoy their desired luxuries, such as brunching on avocado toast or getting manicures, while simultaneously laying the groundwork for enhanced financial stability.

The 50-20-20-10 strategy organizes your spending into broad categories that feel more adaptable to real-life situations. This method ensures you’re covered in essential areas while prioritizing an important aspect most budgeting strategies overlook: investing in your future.

**What distinguishes the 50-20-20-10 method?**

The goals category truly differentiates this method from others. Whether your ambition is to attend law school or invest in a side project, this section prioritizes your income-generating aims. Many believe they cannot afford to invest in themselves, but Sellers states, “you have to spend money to make money.” By dedicating a small percentage of your income (in this case, 10 percent) to starting a side business, you’re positioning yourself to meet this goal and reap financial rewards over time. Sellers emphasizes in a TikTok video that achieving such goals doesn’t require a million dollars in savings—only consistent, incremental investments.

“This method ensures you’re covered in crucial areas while also prioritizing the vital element that most budgeting strategies fail to emphasize: preparing for your future.”

The goal of this category is to think about your future self. How can you set her up for success? What can increase her future income? From that point, identify your goals and outline the steps to achieve them. Sellers illustrates this concept with an example of aspiring to be an angel investor. Initially, you might need funds for conference tickets to gain knowledge or pay for a course that teaches you the essentials. You would allocate 10 percent of your income to that initial step, paving the way toward your ultimate financial goal. In essence, this approach transforms your current earnings into greater wealth in the future.

**Who should utilize the 50-20-20-10 method?**

The 50-20-20-10 budgeting method is appropriate for anyone looking to adopt a more contemporary financial strategy. It is particularly tailored for ambitious, career-oriented, or entrepreneurial women, or really, for anyone who wishes to enjoy life now while simultaneously building wealth. Whether you’re starting your first significant job, aiming to pay off student loans, or keeping your financial future in focus, this method provides a practical and realistic way to remain grounded while prioritizing growth and financial well-being.

**How to implement the 50-20-20-10 method**

1. **Budget for your needs**

Begin by focusing on the essential foundation that constitutes a solid budget

Other articles

Yanina Studilina, Irina Bezrukova, Artyom Ivanov, Katya Guseva and other stars at the premiere of the play "Little Marital Crimes".

Yanina Studilina, Irina Bezrukova, Artyom Ivanov, Katya Guseva and other stars at the premiere of the play "Little Marital Crimes".

On June 9, the closed secular premiere of the play "Little Marital Crimes" took place on the stage of the Attic of Satire. The play, directed by Vladimir Gerasimov, is based on a play by the modern playwright Eric Emmanuel Schmitt. Gilles is a famous author of thrilling detective stories. He has a beautiful wife, a full house and many happy moments in his life. But he had forgotten all that. Accident, amnesia,…

Everything You Need for a Coastal Grandma Summer

From lightweight linens to beach bags, these coastal grandma summer must-haves will give you the feeling of spending the summer in the Hamptons.

Everything You Need for a Coastal Grandma Summer

From lightweight linens to beach bags, these coastal grandma summer must-haves will give you the feeling of spending the summer in the Hamptons.

Success story : interview with Svetlana Tkachenko, owner of the Fashion House Speranza Couture and wedding boutique Wedding Rooms.

Success story : interview with Svetlana Tkachenko, owner of the Fashion House Speranza Couture and wedding boutique Wedding Rooms.

Svetlana, your story is incredibly inspiring. Tell us how Have you decided to move into the fashion world from the banking sector? For me, a woman's mission is to love, create, do what she loves, be inspired and inspire, and light up the world with beauty. I've always felt this in myself, and many have said that I look like a ray of sunshine, giving warmth. My passion for fashion has been in my soul since childhood. Mom worked in a bank, dressed stylishly, exquisitely, and in some amazing way.…

Put Down the Black Leggings—This Is the Subtle Legging Color Trend You'll Spot Everywhere This Summer.

If you dislike wearing black leggings during the summer, follow J.Lo's example and explore the legging color trend she recently showcased. Check out the trend here.

Put Down the Black Leggings—This Is the Subtle Legging Color Trend You'll Spot Everywhere This Summer.

If you dislike wearing black leggings during the summer, follow J.Lo's example and explore the legging color trend she recently showcased. Check out the trend here.

PSA: This Surprising Combination Is the Hottest Beverage of the Summer

documents categorized as *propaganda I'm falling for*

PSA: This Surprising Combination Is the Hottest Beverage of the Summer

documents categorized as *propaganda I'm falling for*

I consistently discover the greatest items at estate sales—here are all my tips for shopping.

If you're interested in discovering how to uncover amazing treasures at estate sales, here are all the tips I've gathered from my experiences in estate sale shopping:

I consistently discover the greatest items at estate sales—here are all my tips for shopping.

If you're interested in discovering how to uncover amazing treasures at estate sales, here are all the tips I've gathered from my experiences in estate sale shopping:

The 50-20-20-10 Budgeting Method Promises to Increase Your Earnings

The 50-20-20-10 budgeting method provides a fresh approach to preparing for your future. Here’s all the information you require, along with steps on how to put it into practice.